How to Link Aadhaar With Epf Account Online

Use a Masked Aadhaar or Virtual ID (VID) in place of the 12-digit Aadhaar card number to be safe.

You can opt to link your Aadhaar to your UAN via the EPFO's Member Sewa Portal, through Biometric Credentials on the e-KYC portal or OTP Verification.

- News18.com

- Last Updated:August 29, 2021, 07:30 IST

- FOLLOW US ON:

FacebookTwitterInstagramTelegramGoogle News

The government of India had issued a mandate outlining the end of August as the last day to link one's Aadhaar card to the Universal Account Number (UAN). If cardholders failed to complete the link by August 31, access to the Employee Provident Fund (EPF) will be restricted. Employers will only be able to file Employee-cum-Return (ECR) challans and deposit the money to the EPF account if the UAN is linked to the Aadhaar before the deadline. Failing to do so will result in employees being unable to withdraw the funds from their PF accounts, nor will they be able to make contributions.

Pooja Ramchandani, a Partner of Shardul Amarchand Mangaldas & Co., said, "Linking of Aadhar to the PF account has become necessary to continue seamless operation of the PF accounts. If not done it can disrupt contribution to and withdrawal from the PF account. In fact, the new Social Security Code makes it mandatory to submit Aadhaar number for even registration as a member or beneficiary of social security benefits under the Code. Employees will have uninterrupted access to the PF benefits under the current legal framework as well as when the Social Security Code comes into force."

Link Aadhaar to UAN Using EPFO's Member Sewa Portal

Step 1: Visit the official website for the Member Sewa Portal and login.

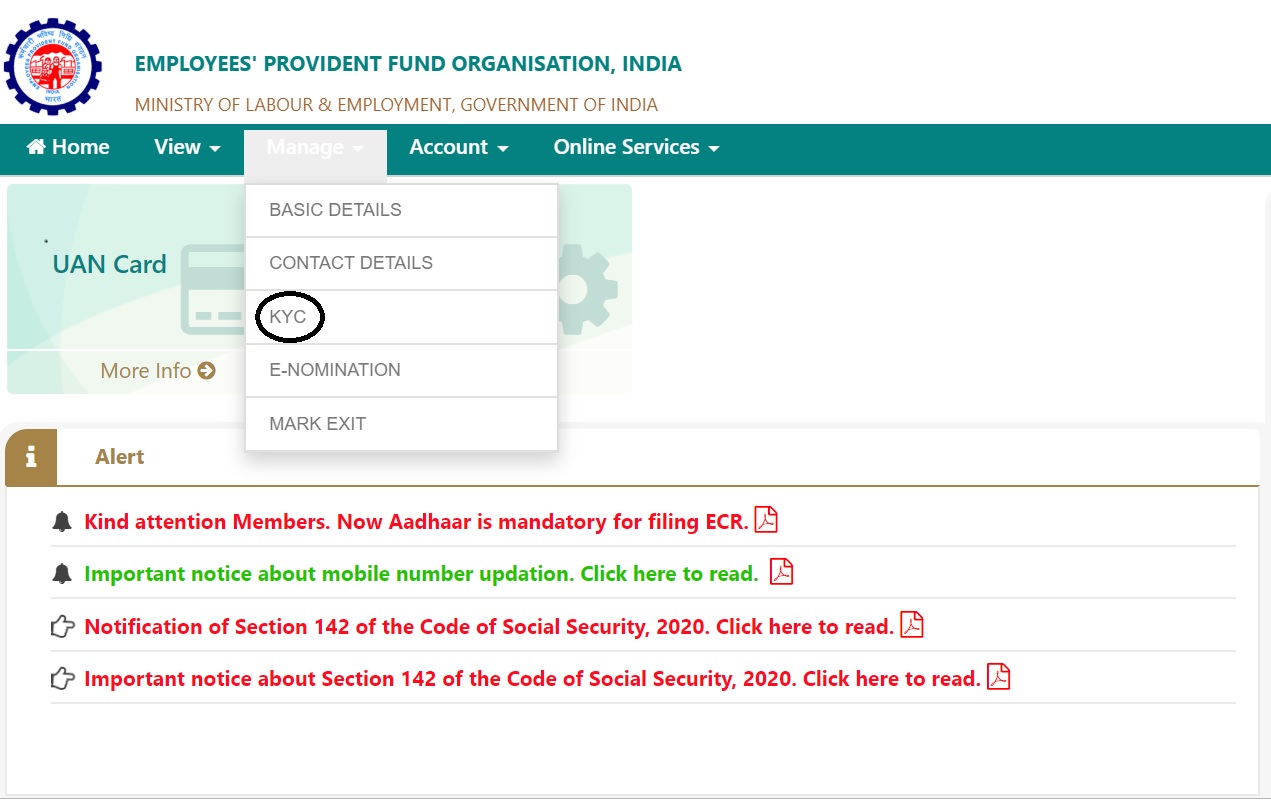

Step 2: Once you are logged in, go to the 'Manage' menu and select the option 'KYC'.

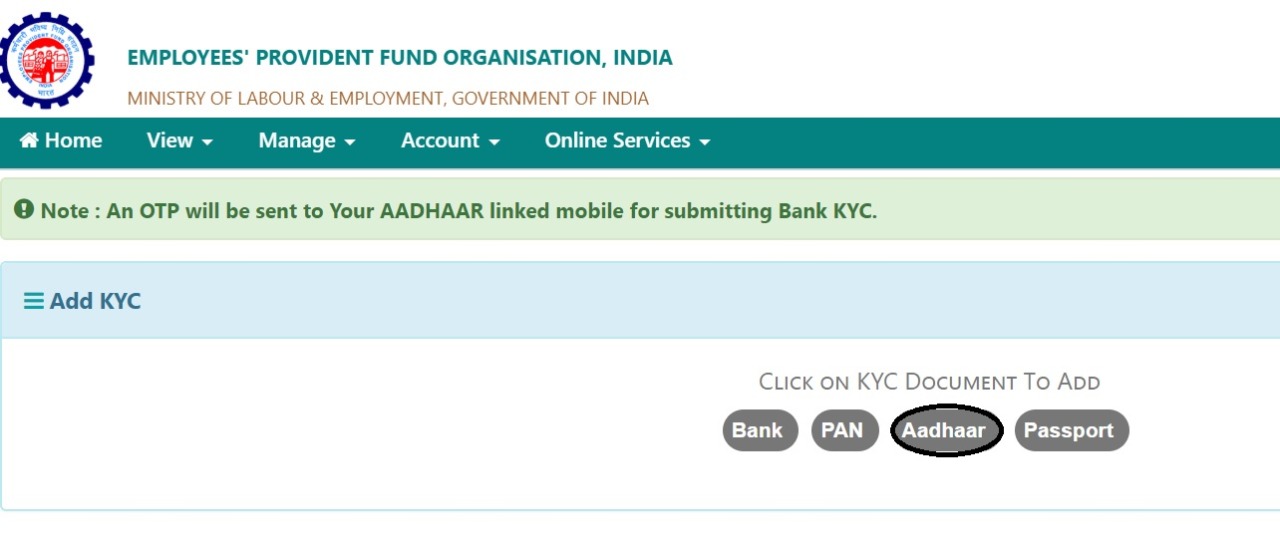

Step 3: Select 'Aadhaar' from the drop-down menu and add your KYC document.

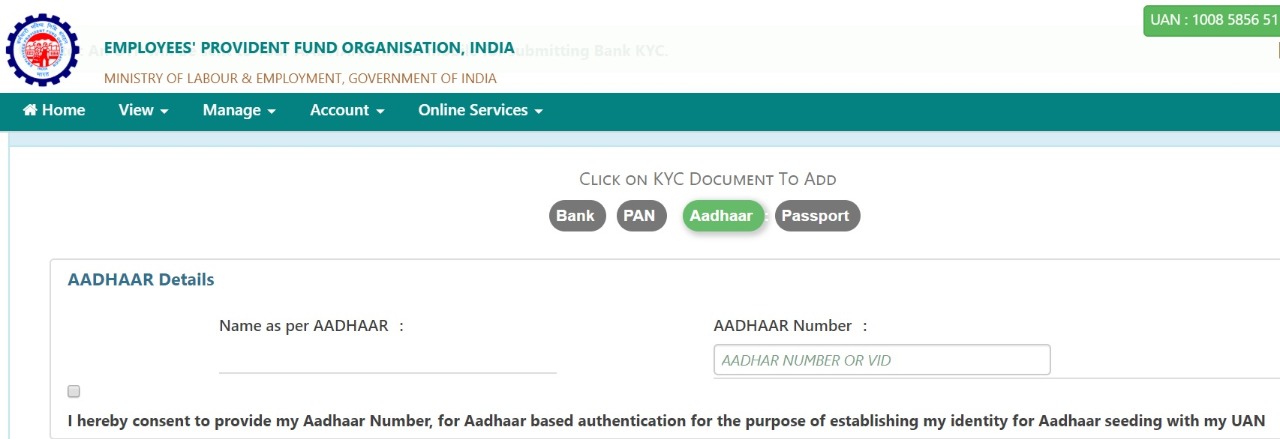

Step 4: You will need to use either your Aadhaar card number or your Virtual ID (VID) to proceed further. Once you have input the number as needed, you have to give consent to an Aadhaar-based authentication.

Step 5: Once you do this click on the 'Save' option. It will then be marked out as 'pending KYC'. It then falls to your employer to give their consent for the UAN to be linked to Aadhaar. For the entire process to be completed successfully it first needs to be accepted by your employer and then the EPFO.

How to Link Aadhaar and UAN via OTP Verification on the e-KYC Portal

Step 1: Go to the website.

Step 2: Click on the 'Link UAN Aadhaar' option that appears under the section 'For EPFO members'.

Step 3: You will then need to fill out the UAN, after which you will receive an OTP to your registered mobile number. You will need to verify this.

Step 4: Once verified, enter your Aadhaar details and select the Aadhaar verification mode, which can be either email or mobile-based OTP.

Step 5: Then the OTP will be sent to your Aadhaar registered phone number or email, whichever the case may be. You simply need to verify this and the linking process will be complete.

Linking the UAN and Aadhaar via Biometric Credentials on the e-KYC portal

Step 1: To start the linking process you need to have a registered biometric device for the ID verification. So, keep that at the ready.

Step 2: The next part requires you to visit the official website and fill in your UAN number under the 'Link UAN Aadhaar' option as mentioned before. This can be found under the 'For EPFO members' section.

Step 3: Once the details are filled in, you will get an OTP on the UAN linked mobile number.

Step 4: Use the OTP and your Aadhaar number to verify and move forward.

Step 5: Use the Biometric measuring device to verify yourself and that is basically the process. Following the verification, your Aadhaar and UAN will be successfully linked.

Read all the Latest News, Breaking News and Afghanistan News here

How to Link Aadhaar With Epf Account Online

Source: https://www.news18.com/news/business/pf-aadhaar-linking-a-must-this-month-to-get-epf-benefits-step-by-step-process-to-link-4137761.html

0 Response to "How to Link Aadhaar With Epf Account Online"

Post a Comment